Using Offshore Trusts to Plan for Retirement with Confidence

Using Offshore Trusts to Plan for Retirement with Confidence

Blog Article

Recognizing the Advantages and Obstacles of Establishing an Offshore Trust Fund for Possession Protection

When thinking about property security, developing an overseas trust may appear attractive. It offers personal privacy, prospective tax obligation benefits, and a method to secure your possessions from creditors. You'll need to navigate lawful considerations and conformity problems that vary across territories.

What Is an Offshore Depend On?

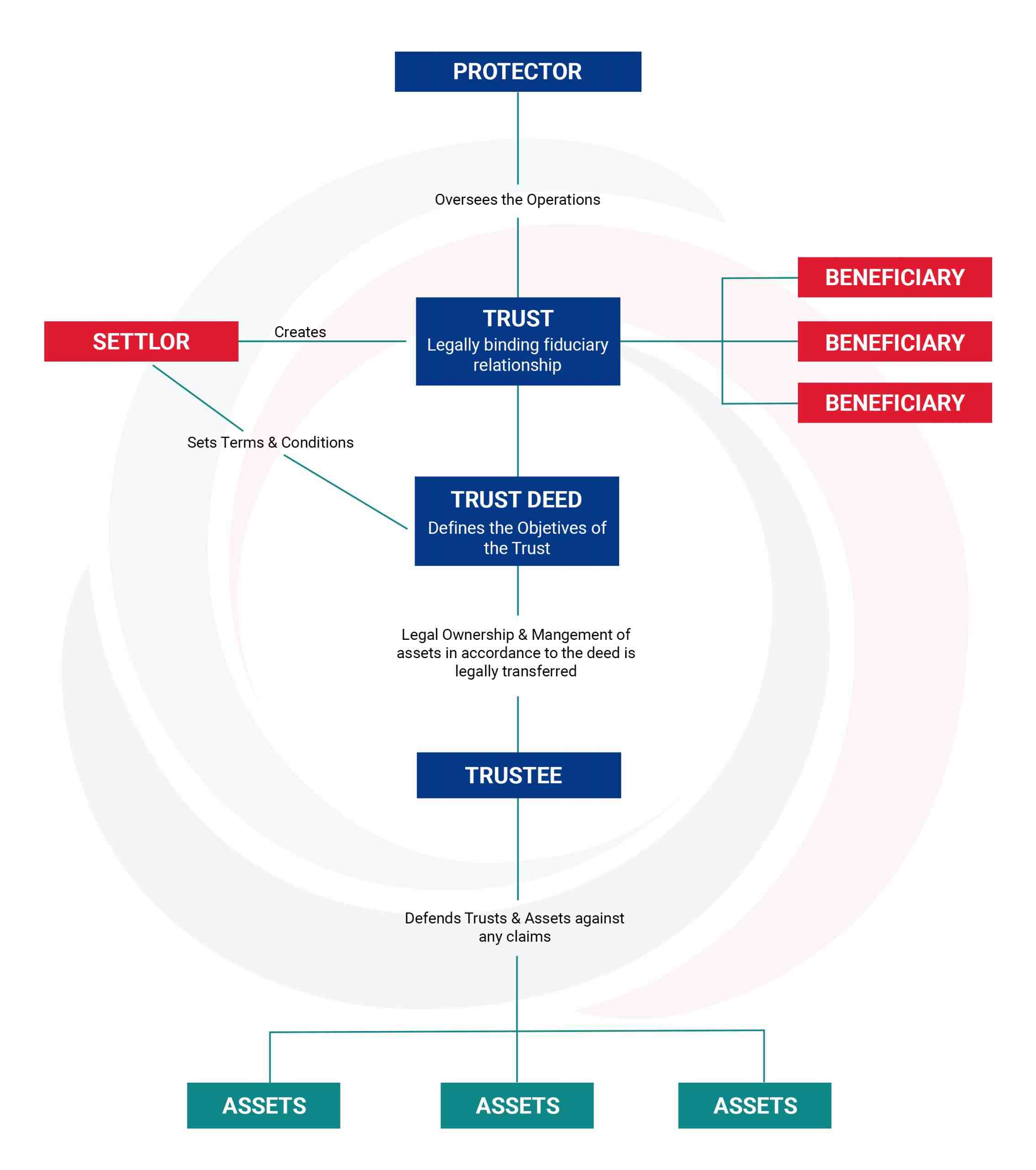

An offshore trust fund is a legal arrangement where you transfer your possessions to a count on that's developed outside your home nation. This arrangement enables you to manage and secure your wealth in a territory with favorable legislations. You can designate a trustee, that will certainly supervise the trust according to your dreams. By doing this, you're not just guarding your possessions yet additionally possibly gaining from personal privacy and tax advantages integral in some overseas jurisdictions.

Key Benefits of Offshore Trusts for Property Protection

When taking into consideration offshore trust funds for property defense, you'll locate several crucial advantages that can greatly impact your economic security. These depends on offer enhanced privacy, tax benefits, and a legal guard from financial institutions. Understanding these advantages can help you make notified decisions concerning your possessions.

Enhanced Privacy Security

Numerous individuals seek offshore depends on not simply for monetary advantages, but also for boosted personal privacy security. By developing an overseas trust fund, you can divide your individual assets from your public identification, which can discourage undesirable interest and possible lawful insurance claims. Most offshore jurisdictions provide strong discretion regulations, making it tough for others to access your trust details.

Tax Obligation Benefits and Motivations

Beyond improved privacy protection, overseas counts on likewise use considerable tax obligation advantages and motivations that can additionally enhance your monetary technique. By developing an overseas depend on, you might delight in reduced tax obligation obligations depending on the jurisdiction you select. Lots of countries supply positive tax obligation rates or exemptions for depends on, allowing your properties to expand without the concern of too much taxation.

Legal Shield From Creditors

Developing an offshore count on provides you an effective lawful shield versus financial institutions, ensuring your possessions continue to be protected when faced with economic challenges. By putting your assets in an overseas depend on, you create an obstacle that makes it hard for creditors to access them. This lawful framework can hinder possible legal actions and insurance claims, as financial institutions may discover it challenging to penetrate the depend on's securities. Additionally, overseas trust funds commonly operate under different legal jurisdictions, which can provide further advantages in asset security. You obtain peace of mind, recognizing your riches is guarded from unpredicted financial problems. Nevertheless, it is essential to understand the lawful demands and effects to fully benefit from this method, guaranteeing conformity and effectiveness in protecting your assets.

Legal Factors To Consider When Developing an Offshore Count On

When you're establishing an offshore depend on, understanding the legal landscape is vital. You'll require to carefully select the right territory and assurance compliance with tax policies to secure your properties successfully. Neglecting these factors might lead to pricey blunders down the line.

Jurisdiction Option Requirements

Choosing the best territory for your overseas trust is necessary, as it can significantly influence the efficiency of your property defense strategy. The ease of trust fund facility and ongoing management likewise matters; some territories use streamlined procedures. Furthermore, evaluate any privacy laws that protect your details, as confidentiality is typically a crucial motivator for selecting an offshore trust.

Conformity With Tax Laws

Recognizing conformity with tax laws is necessary for the success of your offshore depend on. You'll need to familiarize on your own with both your home country's tax laws and those of the overseas jurisdiction. Failing to report your offshore count on can bring about extreme penalties, consisting of substantial fines and possible criminal costs. Make particular you're submitting the required types, like the IRS Type 3520, if you're an U.S. resident. Additionally, maintain comprehensive records of depend on purchases and distributions. Consulting a tax obligation professional who focuses on overseas trust funds can assist you navigate these complexities. By staying certified, you can enjoy the benefits of asset defense without risking legal repercussions. Keep in mind, aggressive planning is key to maintaining your count on's integrity and effectiveness.

Potential Tax Advantages of Offshore Counts On

While many individuals think about overseas trust funds primarily for asset protection, they can also offer substantial tax obligation advantages. By positioning your possessions in an overseas trust fund, you might profit from extra favorable tax obligation treatment than you 'd get in your home country. Many jurisdictions have low or absolutely no tax obligation prices on earnings produced by assets held in these depends on, which can cause substantial cost savings.

Additionally, if you're a non-resident beneficiary, you might stay clear of certain local taxes entirely. This can be especially beneficial for those aiming to maintain wealth throughout generations. Offshore trust funds can offer flexibility in distributing income, potentially enabling you to time circulations for tax effectiveness.

Nevertheless, it's click to read important to consult with a tax obligation expert knowledgeable about both your home country's legislations and the overseas territory's guidelines. Making use of these possible tax advantages requires careful preparation and compliance to ensure you stay within legal boundaries.

Difficulties and Threats Connected With Offshore Counts On

Although offshore trusts can supply numerous advantages, they also feature a variety of challenges and threats that you must thoroughly take into consideration. One substantial obstacle is the complexity of establishing and maintaining the count on. You'll need to navigate numerous lawful and regulative requirements, which can be time-consuming and might require experienced advice.

In addition, expenses can escalate swiftly, from legal fees to ongoing management expenses. It's likewise essential to acknowledge that offshore counts on can attract scrutiny from tax obligation authorities. Otherwise structured appropriately, you could deal with charges or enhanced tax responsibilities.

Furthermore, the possibility for adjustments in regulations or political environments in the territory you've chosen can present risks. These adjustments can influence your trust's efficiency and your access to properties. Ultimately, while overseas depends on can be helpful, comprehending these challenges is essential for making notified decisions regarding your asset security approach.

Choosing the Right Jurisdiction for Your Offshore Trust

How do you pick the appropriate territory for your offshore depend on? Beginning by thinking about the legal structure and asset protection regulations of possible territories. Look for areas understood for solid personal privacy defenses, like the Chef Islands or Nevis. You'll likewise wish to evaluate the jurisdiction's reputation; some are extra reputable than others in the economic world.

Next, think of tax ramifications. Some territories supply tax obligation advantages, while others might not be as beneficial. Offshore Trusts. Ease of access is another element-- choose a location where you can easily connect with trustees and lawful experts

Finally, take into consideration the political and economic stability of the territory. A stable environment assurances your assets are much less most likely to be impacted by unexpected changes. By thoroughly considering these aspects, you'll be better geared up to select the right jurisdiction that lines up with your asset security objectives.

Steps to Developing an Offshore Depend On Successfully

Establishing an overseas count on efficiently calls for cautious planning and a collection of tactical steps. You need to pick the best jurisdiction based on your property protection goals and legal demands. Research the tax obligation effects and privacy legislations in possible areas.

Following, select a reputable trustee that recognizes the subtleties of offshore depends on. This person or institution will certainly handle the trust and warranty conformity with local regulations.

Once you've selected a trustee, draft a complete trust deed outlining your objectives and the beneficiaries included. It's important to talk to legal and monetary consultants throughout this process to validate everything straightens with your goals.

After finalizing the documents, fund the depend on by moving properties. Maintain communication open with your trustee and evaluate the depend on periodically to adapt to any kind of modifications in your scenario or relevant laws. Following these actions faithfully will assist you develop your overseas depend on efficiently.

Regularly Asked Questions

Just how much Does It Cost to Establish up an Offshore Trust?

Establishing an offshore count on generally costs between $5,000 and $20,000. Aspects like intricacy, territory, and professional charges influence the overall cost. You'll intend to budget plan for ongoing upkeep and lawful costs also.

Can I Be Both the Trustee and Beneficiary?

Yes, you can be both the trustee and recipient of an offshore count on, but it's vital to comprehend the lawful ramifications. It may make complex asset protection, so consider getting in touch with a professional for guidance.

Are Offshore Trusts Legal for US People?

Yes, overseas depends on are legal for U.S. residents. Nonetheless, you have to abide by tax coverage you can look here needs and guarantee the count on aligns with united state laws. Consulting a legal expert is necessary to browse the complexities Get More Information involved.

What Occurs if My Offshore Depend On Is Tested?

If your offshore count on is tested, a court may scrutinize its authenticity, possibly resulting in asset recovery. You'll require to give proof supporting its legitimacy and purpose to protect versus any type of claims efficiently.

Just how Do I Choose a Trustee for My Offshore Depend On?

Choosing a trustee for your offshore depend on entails evaluating their experience, online reputation, and understanding of your goals. Try to find somebody trustworthy and educated, and ensure they're acquainted with the laws governing offshore depends on.

Report this page